Note no 1 of August 25 th 2016. (721 words)

How to use a general ledger in accounting ?

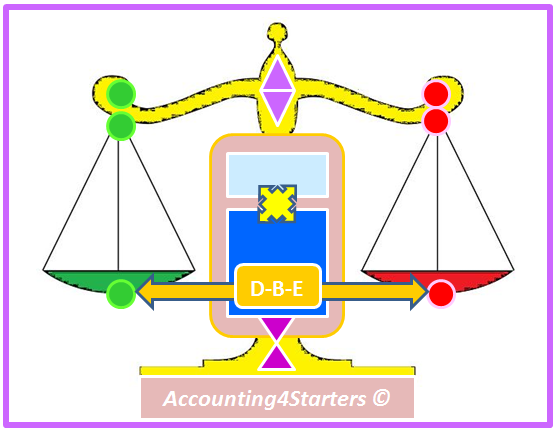

The General Ledger (GL) is the central document only filled by the Journal of Entry. The GL will then concentrate all entries into the Trial Balance. You need to review the Journal & the Trial Balance for a full understanding of the GL. We use a double table to symbolize the GL of a banker in Venice around year 1.400. Read these pages.

We also use a Library storage for Books with 2 parts:

The upper part for the Income Accounts and the lower part for Balance sheet Acc.

A Booking Entry holds 2 Single Booking Items (SBI) symbolized by 2 twin books, one on the left side of a given box & the other on the right side of another box inside the shelves of a library.

In levels 2 & 3, we use a GL-Robot called GLOACK. It will carry a nber of other symbols and signs to serve as a reminder of nearly all technical options for accounting entries, including closing the GL and computing the Profit (or loss) & financial report.

How to define a legal entity in accounting ?

We figure out a company (XYZ) as a legal entity through the comparison with the Earth in relation with satellites. A company will carry its own life, distinct from its shareholders,management, employees, clients , suppliers & other third parties.

XYZ will be first endowed with a given $ capital , like a gift from its shareholders bringing the Capital Funds which can not be taken back. XYZ will then maintain normal relations with others at “arm’s length”, all relationship must be fair & respectfull of all parties. XYZ will not give to others undue privileges, neither be subject to undue pressure.

Back to the Earth scenario, XYZ will keep the daily records of all relations with the outside (the 8 sats) through PC (one per sat). Each PC representing a Class of accounts. Each Satellite represents a type of Business Partners or Objects as per SBOCS formula as defined. Dark blue symbolizes the arm’s length rule. That is the distance between Earth/XYZ & others.

Which accounting links with third parties ?

We use the SBOCS-5 acronym to remember the 5 major types of T.Accounts inside a GL.

XYZ will be founded by its Shareholders (the “S”). Same shareholders will remit cheques representing their subscription to XYZ new Capital.

Such cheques will go to the Bank (the “B”).

With the new funds, XYZ will buy its first Asset (the O of object). Then,XYZ will have its first Clients (the “C”) and its first Suppliers (the “S”).

To get a comprehensive vision of the accounts inside the GL ,you need to understand how these 5 accounts are placed on the GRID designed to represent the GL (called SBI-poster ( See slide S.62 in full glossary) and how they interact between themselves.

On the SBI-poster GRID, see the connections with the income accounts. (costs & revenues).

Such connections are symbolized by a double arrow. A New Cost will impact a supplier account (Payables) a New Sale will impact a client account (Receivables).